AI in Medical Imaging Market Size to Reach USD 21,780 Mn by 2034 Supported by MRI Advancements and Explainable AI Growth

The global AI in medical imaging market size is projected to grow from USD 14.78 million in 2025 to approximately USD 21.78 million by 2034, expanding at a CAGR of 4.4% from 2025 to 2034. Asia Pacific emerging as the fastest-growing region. A study published by Statifacts a sister firm of Precedence Research.

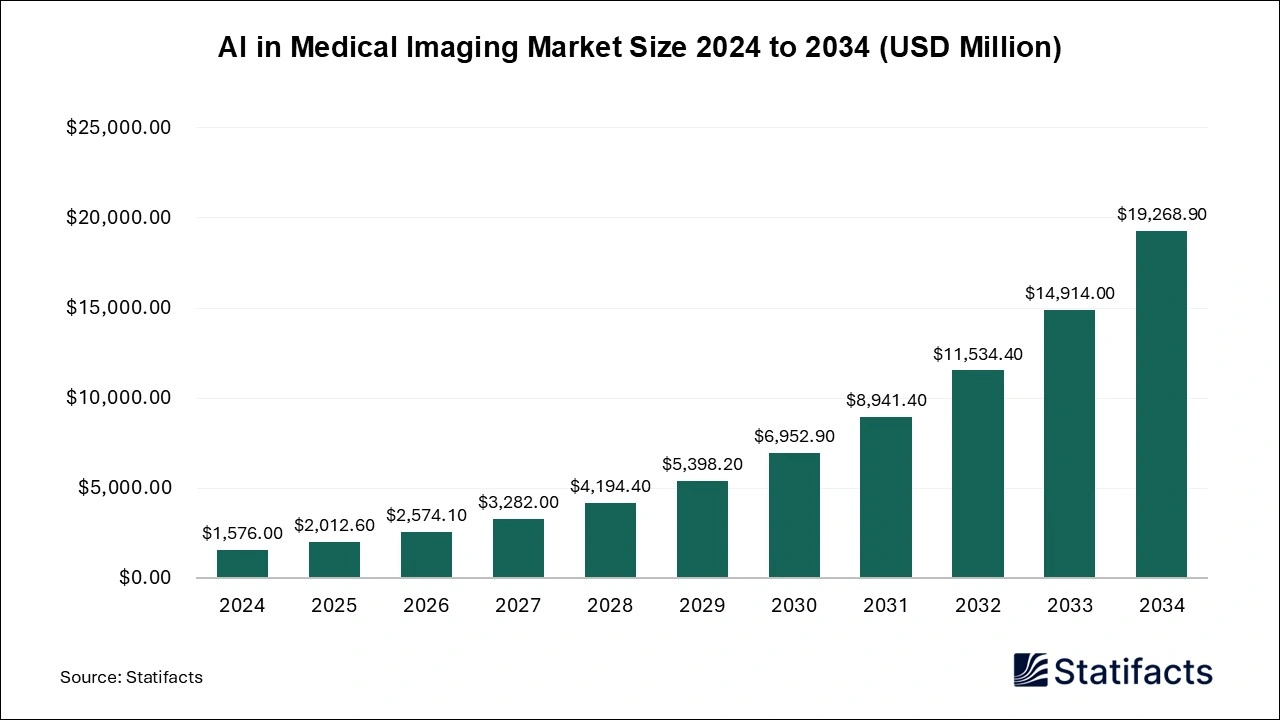

Ottawa, Sept. 16, 2025 (GLOBE NEWSWIRE) -- According to Statifacts, the global AI in medical imaging market size reached USD 14,160 million in 2024 and is estimated to attain USD 21,780 million by 2034, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034. Huge R&D investment from a growing ecosystem of market players and technological innovation in AI is increasing its applications in medical imaging are leading to significant demand in the market.

This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.statifacts.com/stats/databook-download/8106

AI in Medical Imaging Market Highlights

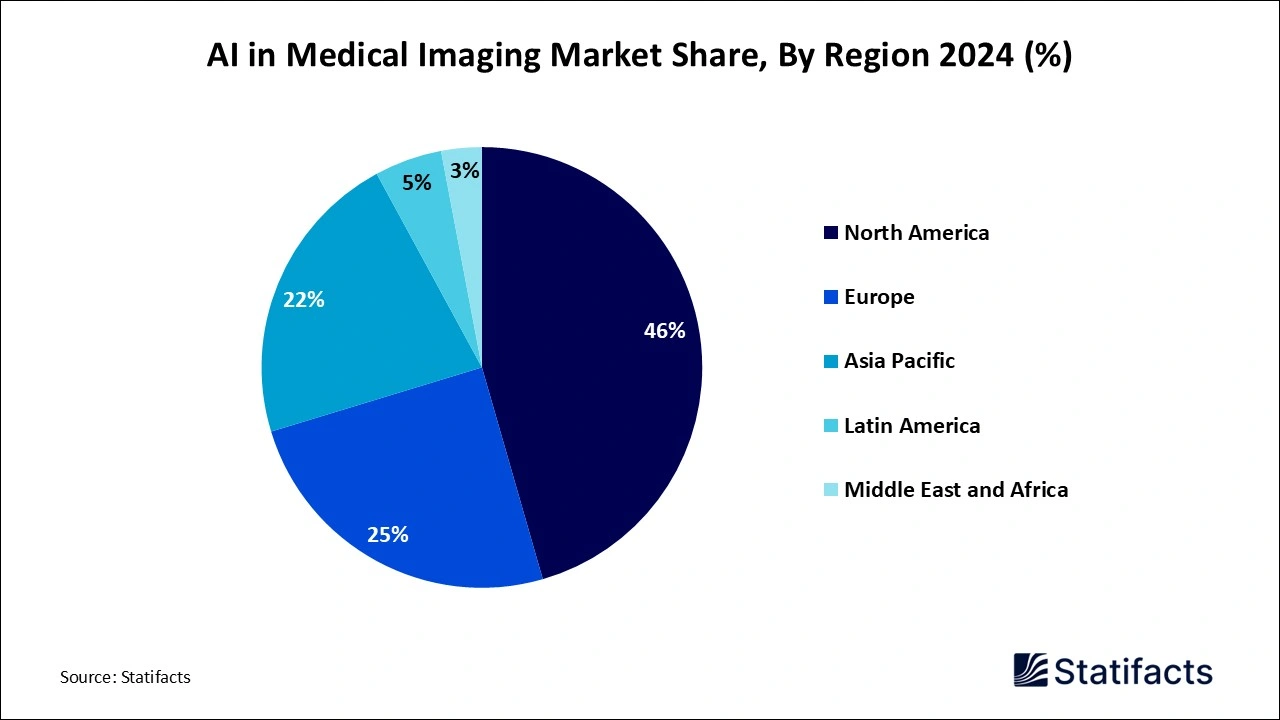

- North America led the regional market, holding 46% of the share in 2024.

- Asia Pacific is projected to experience the fastest growth, with an estimated growth rate of 30.8% from 2025 to 2034.

- Lung/Pulmonology dominated the clinical area segment with a 22% share in 2024, leading the market by clinical area.

- Oncology (excluding Lung, Brain, and Heart) is the fastest growing clinical area, projected to grow at a rate of 30.2% during the forecast period from 2025 to 2034.

- Deep Learning (DL) led the technology type segment, capturing 48% of the market share in 2024.

- Explainable AI (XAI) is expected to see the fastest growth, with a projected growth rate of 30.0% over the next decade.

- On-Premise deployment type dominated the market, holding 58% of the share in 2024.

- Edge/Embedded deployment is anticipated to grow the fastest, with an estimated growth rate of 30.8% from 2025 to 2034.

- CT imaging modality dominated the market, accounting for 37% of the market share in 2024.

- MRI imaging modality is forecasted to experience the fastest growth, projected to grow at a rate of 30.0% in the coming years.

- Image Analysis functionality led the market with a dominant share of 51% in 2024.

- Image Acquisition & Reconstruction functionality is expected to grow the fastest, with an anticipated growth rate of 29.6% during the forecast period.

- Software was the dominant product type, holding the largest market share in 2024.

- Software is also the fastest growing product type, with significant growth expected in the coming years.

- Hospitals held the largest share of the end-user segment, accounting for 65% of the market in 2024.

- Diagnostic Imaging Centers are projected to experience the fastest growth, with a growth rate of 28.9% in the forecast period.

AI in Medical Imaging Market Size by Clinical Area, 2022 to 2024 (USD Million)

| Segments | 2022 | 2023 | 2024 |

| Lung / Pulmonology | 210.19 | 267.64 | 341.59 |

| Brain / Neurology | 190.54 | 241.42 | 306.61 |

| Heart / Cardiology | 130.67 | 166.44 | 212.49 |

| Oncology (Other than Lung, Brain, Heart) | 116.13 | 149.36 | 192.50 |

| Musculoskeletal | 90.66 | 115.79 | 148.24 |

| Gastroenterology / Hepatology | 72.29 | 91.57 | 116.27 |

| Ophthalmology | 59.72 | 75.81 | 96.46 |

| Other Specialties (Obstetrics/Gynecology, Urology, Dermatology) | 107.71 | 131.97 | 161.88 |

AI in Medical Imaging Market Size by Technology Type, 2022 to 2024 (USD Million)

| Segments | 2022 | 2023 | 2024 |

| Machine Learning (ML) | 164.34 | 205.30 | 257.01 |

| Deep Learning (DL) | 465.98 | 593.24 | 757.03 |

| Natural Language Processing (NLP) | 67.24 | 84.50 | 106.42 |

| Hybrid / Multimodal AI | 108.84 | 136.75 | 172.21 |

| Explainable AI (XAI) | 171.50 | 220.21 | 283.38 |

AI in Medical Imaging Market Size by Deployment Type, 2022 to 2024 (USD Million)

| Segments | 2022 | 2023 | 2024 |

| On-Premise | 571.11 | 722.47 | 916.10 |

| Cloud-Based | 243.54 | 312.41 | 401.66 |

| Hybrid | 132.89 | 165.76 | 207.21 |

| Edge / Embedded | 30.38 | 39.35 | 51.08 |

AI in Medical Imaging Market Size by Imaging Modality, 2022 to 2024 (USD Million)

| Segments | 2022 | 2023 | 2024 |

| X-ray | 198.74 | 251.13 | 318.07 |

| CT | 362.53 | 458.42 | 581.06 |

| MRI | 191.72 | 246.19 | 316.84 |

| Ultrasound | 114.53 | 145.43 | 185.11 |

| PET / SPECT | 44.27 | 56.75 | 72.92 |

| Other Imaging Modalities (Endoscopy, etc.) | 66.13 | 82.07 | 102.05 |

AI in Medical Imaging Market Size by Functionality, 2022 to 2024 (USD Million)

| Segments | 2022 | 2023 | 2024 |

| Image Acquisition & Reconstruction | 90.03 | 115.12 | 147.55 |

| Image Enhancement & Processing | 122.22 | 155.19 | 197.50 |

| Image Analysis | 493.83 | 628.39 | 801.50 |

| Workflow & Reporting | 138.17 | 174.38 | 220.60 |

| Predictive & Prognostic Analytics | 133.67 | 166.92 | 208.88 |

AI in Medical Imaging Market Size by Product Type, 2022 to 2024 (USD Million)

| Segments | 2022 | 2023 | 2024 |

| Software | 743.42 | 945.16 | 1204.49 |

| AI-Enabled Hardware | 234.50 | 294.84 | 371.55 |

AI in Medical Imaging Market Size by End User, 2022 to 2024 (USD Million)

| Segments | 2022 | 2023 | 2024 |

| Hospitals | 634.66 | 804.46 | 1022.10 |

| Diagnostic Imaging Centers | 247.99 | 315.48 | 402.29 |

| Research & Academic Institutes | 95.27 | 120.05 | 151.64 |

Market Overview & Potential for AI in Medical Imaging:

AI in the medical imaging market refers to the production, distribution, and use of medical imaging, which includes using machine learning algorithms. AI systems can analyze medical images with speed and precision, aiding in the identification of early-stage diseases that may be difficult to detect through traditional methods. According to a report published in September 2025, NIH is preparing to launch a program using AI to conduct precision medicine using imaging scans across departments. Chris Kinsinger, assistant director for catalytic data resources at the NIH Common Fund, shared while speaking at the AFCEA Health IT Summit 2025 in Washington. Source: Meri Talk

Artificial intelligence (AI) in imaging is its ability to improve the accuracy and efficiency of disease diagnosis. AI in medical imaging is transforming healthcare by improving diagnostic accuracy and efficiency. AI algorithms can quickly analyze large amounts of imaging data, identifying patterns and abnormalities that may be overlooked by human eyes. This method aids in the early detection and treatment of diseases like cancer and cardiovascular conditions by providing consistent and precise image analysis. AI-based medical imaging tools are transforming healthcare by improving diagnostic accuracy and efficiency. These advanced systems use deep learning algorithms, convolutional neural networks, and computer vision technology to analyze medical images with unprecedented precision.

Major Applications of AI in Medical Imaging

-

Cancer Detection and Diagnosis

AI algorithms analyze medical images such as mammograms, CT scans, and MRIs to detect tumors and abnormalities with high accuracy. These tools help radiologists identify cancers at earlier stages, improving treatment outcomes and patient survival rates. -

Image Segmentation and Annotation

AI automates the process of delineating organs, tissues, and lesions within medical images, reducing manual workload. This precise segmentation supports treatment planning, surgical navigation, and disease monitoring. -

Disease Classification and Prognosis

By interpreting imaging patterns, AI models classify disease types and predict their progression, aiding in personalized treatment strategies. This enables clinicians to make informed decisions and optimize patient management. -

Workflow Optimization and Prioritization

AI helps prioritize urgent cases by flagging critical findings, thus reducing diagnostic delays in emergency settings. Automated triaging improves radiologist efficiency and ensures faster patient care. -

Radiology Report Generation

Natural language processing (NLP) integrated with AI assists in generating structured radiology reports from imaging data. This reduces reporting time and enhances consistency in clinical documentation. -

Quantitative Imaging and Biomarker Extraction

AI extracts quantitative data from images, such as tumor volume or tissue density, providing objective biomarkers. These metrics support treatment response evaluation and clinical trials.

AI in Medical Imaging Market Trends

- Improved diagnostic accuracy and treatment: Artificial intelligence (AI) in diagnostic imaging has the potential to improve the accuracy and efficiency of interpreting medical images like CT scans, X-rays, and MRIs. AI algorithms can analyze medical data to assist doctors in making improved diagnoses by studying patient histories, lab results, and genetic information. By identifying patterns and correlations within the data, AI improves diagnostic accuracy and allows personalized treatment planning.

- Increasing R&D investment: One of the standard features of AI in medical imaging in R&D is its ability to sift through millions of research papers, patents, and industry reports. AI in medical imaging in the R&D field is applicable in countless other the ability to automate routine and repetitive tasks. Automating tasks like data collection, data entry, documentation, and analysis not only saves time for human employees but also reduces the possibility of human error.

- Shortage of radiologists: AI-based health technologies within radiology will increase workflow efficiency, improve diagnostic accuracy, reduce healthcare-related costs, and alleviate medical staff shortages. Radiologists are still an essential part of healthcare and will remain so in the foreseeable future. AI is mainly useful in identifying and annotating localized cancers. Additionally, AI is able to perform these tasks very quickly, with reproducible results. Radiologists can identify the extent of the tumor better than AI.

- Technological advancement in AI in medical imaging: The benefits of technological advancements in AI in medical imaging include patient empowerment, image acquisition & quality control, faster diagnosis, ethical & legal issues, efficiency in AI-based image assessment, early detection, diagnosis, data processing, consistent quality, breast cancer, applications in image analysis, aligning medical guidelines with AI outputs, improved diagnostic accuracy, dose optimization, brain tumors, personalized medicines, increased efficiency, optimizing workflows, and accuracy.

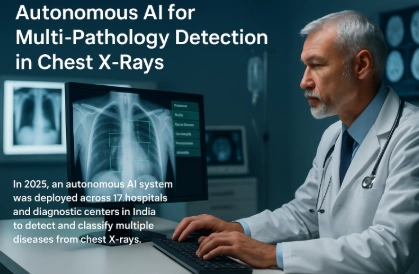

Case Study: Autonomous AI for Multi-Pathology Detection in Chest X-Rays (India, 2025)

Overview:

In 2025, India witnessed one of the largest real-world deployments of AI in medical imaging, where an autonomous system was introduced across 17 hospitals and diagnostic centers. Designed to assist overburdened radiologists, this AI tool could detect, classify, and segment 75 different diseases from chest X-rays with near-perfect accuracy.

Background:

Chest X-rays remain the most widely used imaging modality, but radiologist shortages often delay diagnosis. To address this, researchers introduced an AI platform capable of handling massive scan volumes while supporting early detection of critical conditions like tuberculosis, pneumonia, and lung cancer.

What Was Done:

- Integrated Vision Transformers, Faster R-CNN, and U-Net models.

- Deployed across 17 healthcare institutions in India.

- Analyzed 150,000+ chest X-ray scans in real clinical workflows.

Key Results:

- Multi-pathology detection: ~98% precision and >95% recall.

- Normal vs abnormal detection: ~99.8% accuracy.

- Scalable performance: Worked across diverse hospitals, equipment, and patient demographics.

- Impact: Greatly reduced radiologist workload and diagnostic delays.

Why It Matters for the Market:

This case strongly aligns with your press release insights

- Asia-Pacific Growth: Demonstrates real-world adoption in India, supporting the region’s projected fastest CAGR of 30.8%.

- Radiologist Shortages: Directly addresses the workforce gap highlighted in your report.

-

Workflow Efficiency: Showcases how AI improves triaging and reporting, core market drivers.

Customize This Study as Per Your Requirement@ https://www.statifacts.com/stats/customization/8106

AI in Medical Imaging Market Dynamics

Market’s Key Driver: Rising Prevalence of Chronic Diseases and Aging Population

The increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions is a primary driver accelerating the adoption of AI in medical imaging. As the global population ages, the demand for early diagnosis, precise disease monitoring, and personalized treatment intensifies. AI-powered imaging tools offer faster, more accurate detection and analysis of complex medical conditions, enabling healthcare providers to improve patient outcomes and reduce diagnostic errors.

Moreover, AI assists in managing the growing volume of imaging data generated by healthcare systems, making it easier for radiologists to prioritize urgent cases and enhance workflow efficiency. This combination of clinical need and operational efficiency is pushing healthcare providers worldwide to integrate AI technologies into medical imaging.

Restraint: Data Privacy and Regulatory Challenges

Despite the promising advancements, data privacy concerns and regulatory hurdles remain significant restraints to the widespread adoption of AI in medical imaging. Medical imaging data is highly sensitive, and the collection, storage, and processing of this information require strict compliance with data protection laws such as HIPAA in the U.S. and GDPR in Europe. Ensuring patient confidentiality while enabling AI algorithms to access large, diverse datasets for training poses a complex challenge.

Opportunity: Integration of AI with Cloud Computing and Telemedicine

The convergence of AI with cloud computing and telemedicine presents a significant growth opportunity in the medical imaging market. Cloud-based platforms enable real-time sharing and analysis of imaging data, allowing remote access to AI-powered diagnostic tools regardless of geographic barriers. This integration is particularly beneficial for underserved and rural areas where access to skilled radiologists is limited. Telemedicine combined with AI imaging can facilitate faster diagnosis, second opinions, and continuous patient monitoring, reducing the need for hospital visits and enabling proactive healthcare.

Ready to Dive Deeper? Visit Here to Buy Databook & In-depth Report Now@ https://www.statifacts.com/order-databook/8106

AI in Medical Imaging Market Scope

| Report Attribute | Key Statistics | |

| Market Size in 2023 | USD 1,240 Million | |

| Market Size in 2024 | USD 1,576.04 Million | |

| Market Size in 2025 | USD 2,012.60 Million | |

| Market Size in 2028 | USD 4,194.4 Million | |

| Market Size in 2031 | USD 8,941.40 Million | |

| Market Size by 2034 | USD 19,268.9 Million | |

| CAGR 2025-2034 | 28.5% | |

| Leading Region in 2024 | North America | |

| Fastest Growing Region | Asia-Pacific | |

| Base Year | 2024 | |

| Forecast Period | 2025 to 2034 | |

| Segments Covered | By Clinical Area, By Technology Type, By Deployment Type, By Imaging Modality, By Functionality, By Product Type, By End User and By Region | |

| Regional analysis | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

| Leading Players | GE HealthCare, Microsoft, Digital Diagnostics Inc., TEMPUS, Butterfly Network Inc, Advanced Micro Devices Inc, HeartFlow Inc, Enlitic Inc, Canon Medical Systems USA, Inc, Viz.ai Inc, EchoNous Inc, HeartVista Inc, Exo Imaging Inc, Nano-X Imaging Ltd, and Others. | |

Kindly use the following link to access our scheduled meeting@ https://www.statifacts.com/schedule-meeting

AI in Medical Imaging Market Segmentation

Clinical Area Insights

In 2024, lung/pulmonology emerged as the dominant clinical area for AI in medical imaging, owing to the critical need for early detection and monitoring of conditions such as lung cancer, COPD, and COVID-related complications. The accuracy and speed of AI-driven lung image analysis have significantly improved diagnostic outcomes, making this area a priority in hospitals and imaging centers.

At the same time, oncology (excluding lung, brain, and heart) has surfaced as the fastest growing clinical segment, driven by the increasing burden of cancers across various organ systems. The push for early-stage detection, personalized treatment planning, and improved survival outcomes has accelerated AI adoption in broader oncological imaging.

Technology Type Insights

Deep learning (DL) continues to dominate the AI technology landscape in medical imaging in 2024. Its ability to automatically learn complex features from vast imaging datasets makes it indispensable for tasks like anomaly detection, image segmentation, and classification. DL’s performance in delivering high diagnostic accuracy has made it the backbone of most commercial AI imaging tools.

Meanwhile, explainable AI (XAI) is the fastest growing technology, gaining traction due to rising concerns around transparency, trust, and accountability in AI-assisted diagnoses. XAI allows clinicians to understand the rationale behind AI decisions, fostering greater confidence and adoption in clinical workflows.

Deployment Type Insights

On-premise deployment remained the dominant model in 2024, primarily due to stringent data security regulations, the need for integration with existing hospital infrastructure, and control over data governance. Hospitals and large healthcare facilities continue to favor this model to maintain compliance and safeguard sensitive patient information.

However, edge and embedded AI deployments are growing at the fastest rate, fueled by the demand for real-time processing, especially in remote or decentralized settings. These lightweight, on-device AI models enable faster decision-making without relying on cloud connectivity, making them ideal for point-of-care diagnostics and mobile imaging units.

By Imaging Modality Insights

Computed Tomography (CT) remains the most dominant imaging modality utilizing AI in 2024. Its widespread usage in emergency care, oncology, and pulmonary imaging, combined with the availability of large annotated datasets, has made it a natural fit for AI enhancement. AI applications in CT, such as nodule detection and automatic segmentation, are widely adopted and proven.

In contrast, magnetic resonance imaging (MRI) has emerged as the fastest growing modality for AI integration. Advances in AI-powered image reconstruction, noise reduction, and scan acceleration are making MRI more accessible and efficient, expanding its use in neurology, musculoskeletal, and cardiac imaging.

Functionality Insights

Image analysis continues to be the dominant functionality in the AI medical imaging space in 2024. AI tools for detection, segmentation, quantification, and classification of abnormalities have become essential in supporting radiologists in clinical decision-making. These tools significantly reduce reading time and increase diagnostic accuracy across imaging modalities.

At the same time, image acquisition and reconstruction represents the fastest growing functional segment. AI is being used to optimize scan protocols, reduce radiation dose, and enhance image quality, which not only improves patient safety but also shortens examination times and operational costs.

Product Type Insights

Software dominates the AI in medical imaging market by product type, as it encompasses a wide range of applications from diagnostic algorithms to workflow automation and reporting tools. Software solutions offer scalability, frequent updates, and integration with existing radiology information systems (RIS) and picture archiving and communication systems (PACS). Interestingly, software is also the fastest growing product type, highlighting the ongoing innovation in algorithm development and the increasing preference for cloud-based and modular AI platforms that can be tailored to specific clinical needs and infrastructure.

End User Insights

Hospitals were the leading end users of AI in medical imaging in 2024, leveraging these technologies for comprehensive diagnostics, cross-specialty coordination, and large patient volumes. The integration of AI into hospital imaging workflows has improved diagnostic efficiency, reduced radiologist burnout, and enabled faster clinical decision-making.

On the other hand, diagnostic imaging centers are the fastest growing end user segment, driven by their need to remain competitive, improve turnaround times, and offer cutting-edge services. These centers are increasingly adopting AI to enhance workflow automation, boost image interpretation accuracy, and attract referrals from specialists and general practitioners.

Regional Insights

North America: Leading in AI in Medical Imaging Market

North America dominated the global AI in medical imaging market in 2024, driven by a unique combination of regulatory support, high healthcare expenditure, advanced infrastructure, and a growing emphasis on digital transformation in healthcare. The region benefits from an ecosystem that encourages innovation, rapid adoption of AI technologies, and a proactive approach to tackling systemic challenges such as radiologist shortages and the rising burden of chronic diseases.

In the United States, the integration of AI into medical imaging, particularly in radiology, has accelerated significantly. The U.S. Food and Drug Administration (FDA) has emerged as a key enabler, with over 1,000 AI-enabled medical devices receiving market authorization as of 2024, approximately 76% of which are dedicated to radiology. This highlights a growing trust in AI tools to assist in image analysis, anomaly detection, and even autonomous diagnostic support. The FDA’s evolving regulatory framework, including initiatives like the Digital Health Center of Excellence, supports continuous innovation while maintaining patient safety and data transparency.

Asia Pacific AI in Medical Imaging Market Trends:

The Asia Pacific region is emerging as the fastest-growing market for AI in medical imaging, driven by several key factors. Rapidly expanding healthcare infrastructure, increasing government investments in digital health technologies, and rising awareness of AI’s potential in improving diagnostic accuracy are fueling growth. Countries like China, India, Japan, and South Korea are witnessing significant adoption of AI-powered imaging solutions to address the growing burden of chronic diseases such as cancer and cardiovascular conditions. Additionally, the shortage of skilled radiologists and the urgent need to improve diagnostic efficiency in densely populated regions are accelerating the demand for AI-driven tools.

Browse More Research Reports:

- The U.S. medical imaging outsourcing market size is calculated at USD 14,160 million in 2024 and is predicted to attain around USD 21,780 million by 2034, expanding at a CAGR of 4.4% from 2025 to 2034.

- The global diagnostic imaging equipment market size surpassed USD 21.14 billion in 2024 and is predicted to reach around USD 72.48 billion by 2034, registering a CAGR of 13.11% from 2025 to 2034.

- The US diagnostic imaging market size accounted for USD 5.35 billion in 2024 and is predicted to touch around USD 19.74 billion by 2034, growing at a CAGR of 13.94% from 2025 to 2034.

- The global live cell imaging market size was calculated at USD 2,730 million in 2024 and is predicted to attain around USD 6,520 million by 2034, expanding at a CAGR of 9.1% from 2025 to 2034.

- The global biological imaging reagents market size accounted for USD 13,430 million in 2024 and is expected to exceed around USD 27,410 million by 2034, growing at a CAGR of 7.4% from 2025 to 2034.

- The U.S. clinical trial imaging market size was exhibited at USD 619 million in 2024 and is projected to hit around USD 1,349 million by 2034, growing at a CAGR of 8.1% during the forecast period 2024 to 2034.

- The global veterinary imaging market size accounted for USD 2,275 million in 2024 and is expected to exceed around USD 4,351 million by 2034, growing at a CAGR of 6.7% from 2024 to 2034.

- The global medical hyperspectral imaging market size was valued at USD 211 million in 2024 and is predicted to gain around USD 374.32 million by 2034 with a CAGR of 5.9% 2024 to 2034.

Ready to Dive Deeper? Visit Here to Buy Databook & In-depth Report Now@ https://www.statifacts.com/order-databook/8106

AI in Medical Imaging Market Top Companies

- HeartVista Inc. – Specializes in AI-powered MRI software that enables real-time, automated cardiac imaging with minimal operator input.

- EchoNous, Inc. – Develops AI-enhanced handheld ultrasound devices designed to simplify and accelerate diagnostic imaging.

- Viz.ai, Inc. – Offers an AI platform that streamlines stroke detection and triage by analyzing CT scans in real time.

- Canon Medical Systems USA, Inc. – Provides advanced imaging systems integrated with deep learning algorithms for improved diagnostic accuracy and workflow efficiency.

- Enlitic, Inc. – Utilizes deep learning to enhance radiology workflows, improve data interoperability, and support clinical decision-making.

- HeartFlow, Inc. – Delivers AI-based analysis of coronary CT scans to provide non-invasive assessment of heart disease.

- Advanced Micro Devices, Inc. (AMD) – Supplies high-performance computing hardware essential for running complex AI algorithms in medical imaging applications.

- Butterfly Network, Inc. – Offers a portable, AI-enabled ultrasound device that connects to smartphones and democratizes access to imaging.

- TEMPUS – Combines AI and precision medicine to derive actionable insights from imaging, clinical, and molecular data.

- Digital Diagnostics Inc. – Pioneers autonomous AI diagnostics, including FDA-approved tools that analyze medical images without clinician input.

- Microsoft – Supports AI in medical imaging through its Azure cloud platform, offering scalable computing and machine learning services to healthcare providers.

- GE HealthCare – Integrates AI across its imaging portfolio to enhance clinical decision support, reduce scan time, and optimize radiology workflows.

Recent Developments

- In July 2025, a cutting-edge Magnetic Resonance Imaging (MRI) research facility was inaugurated by the Indian Institute of Technology Delhi (IIT Delhi), in a move to transform biomedical research. Unlike conventional MRI setups embedded within hospital ecosystems, this facility is designed to foster unrestricted innovation in medical imaging, particularly in Magnetic Resonance Imaging (MRI). This facility will enable innovative research in various areas across MRI applications, including the integration of artificial intelligence in image processing. Source: The New Indian Express

- In July 2025, the state-of-the-art Mahajan Imaging & Labs Center at Dwarka was inaugurated by the Honorable Lieutenant Governor of Delhi, Vinai Kumar Saxena. Marking a National first, the center introduces the Ultra-Fast AI-Powered Excel 3T MRI Scanner. This movement is expected to set a novel standard for cutting-edge medical imaging and integrated diagnostics in India. Source: Ehealth Eletsonline

Segments Covered in the Report

By Clinical Area

- Lung / Pulmonology

- Lung Cancer

- Non-cancer Lung Diseases (COPD, TB, Pneumonia, ILD)

- Brain / Neurology

- Stroke / Hemorrhage

- Dementia & Neurodegenerative Diseases

- Brain Tumors / Lesions

- Heart / Cardiology

- Coronary Artery Disease

- Heart Failure & Functional Assessment

- Congenital & Structural Heart Disease

- Oncology (Other than Lung, Brain, Heart)

- Musculoskeletal

- Gastroenterology / Hepatology

- Ophthalmology

- Other Specialties (Obstetrics/Gynecology, Urology, Dermatology)

By Technology Type

- Machine Learning (ML)

- Deep Learning (DL)

- CNN

- RNN / LSTM

- Transformers / ViTs

- Generative Models (GANs, Diffusion)

- Natural Language Processing (NLP)

- Hybrid / Multimodal AI

- Explainable AI (XAI)

By Deployment Type

- On-Premise

- Cloud-Based

- Hybrid

- Edge / Embedded

By Imaging Modality

- X-ray

- CT

- MRI

- Ultrasound

- PET / SPECT

- Other Imaging Modalities (Endoscopy, etc.)

By Functionality

- Image Acquisition & Reconstruction

- Image Enhancement & Processing

- Image Analysis

- Segmentation

- Detection

- Classification

- Quantification

- Workflow & Reporting

- Predictive & Prognostic Analytics

By Product Type

- Software

- AI Analysis Software (standalone, PACS-integrated, SaaS)

- AI Workflow & Reporting Tools

- AI-Enabled Hardware

- Imaging Devices with Embedded AI (CT, MRI, X-ray, Ultrasound)

- Edge / AI Workstations

- AI Accelerators (GPU/TPU-enabled servers for imaging)

By End User

- Hospitals

- Diagnostic Imaging Centers

- Research & Academic Institutes

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here - https://www.statifacts.com/get-a-subscription

Contact US

- Ballindamm 22, 20095 Hamburg, Germany

- Web: https://www.statifacts.com/

-

Europe: +44 7383 092 044

About US

Statifacts is a leading provider of comprehensive market research and analytics services, offering over 1,000,000 market and custoer data sets across various industries. Their platform enables businesses to make informed strategic decisions by providing full access to statistics, downloadable in formats such as XLS, PDF, and PNG.

Our Trusted Data Partners:

Precedence Research | Towards Healthcare | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Nova One Advisor

Explore More Reports:

- Shore Power Market Size - https://www.statifacts.com/outlook/shore-power-market

- Ocean Current Energy Conversion Market Size - https://www.statifacts.com/outlook/ocean-current-energy-conversion-market

- Transition Piece (TP) Market Size - https://www.statifacts.com/outlook/transition-piece-market

- Aviation Power Battery System Market Size - https://www.statifacts.com/outlook/aviation-power-battery-system-market

- Aftermarket Automotive Sport Seats Market Size - https://www.statifacts.com/outlook/aftermarket-automotive-sport-seats-market

- Battery Electric Vehicle (BEV) Charging Inlets Market Size - https://www.statifacts.com/outlook/battery-electric-vehicle-charging-inlets-market

- Electric Vehicle Steering System Market Size - https://www.statifacts.com/outlook/electric-vehicle-steering-system-market

- Pumper Fire Truck Market Size - https://www.statifacts.com/outlook/pumper-fire-truck-market

- Automotive Sports Style Seats Market - https://www.statifacts.com/outlook/automotive-sports-style-seats-market

- Automotive Seat Foam Market Size - https://www.statifacts.com/outlook/automotive-seat-foam-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.